This post is also available in: हिन्दी (Hindi)

Dear Readers, Daily Current Affairs Questions Quiz for SBI, IBPS, RBI, RRB, SSC Exam 2024 of 03rd July 2024. Daily GK quiz online for bank & competitive exam. Here we have given the Daily Current Affairs Quiz based on the previous days Daily Current Affairs updates. Candidates preparing for IBPS, SBI, RBI, RRB, SSC Exam 2024 & other competitive exams can make use of these Current Affairs Quiz.

1) As per July 2024, how many ASEAN (Association of Southeast Asian Nations) nations’ central banks have partnered with the Reserve Bank of India (RBI) and the Bank for International Settlements (BIS) to work on Project Nexus, a multilateral international project to facilitate retail cross-border payments?

(a) 5

(b) 4

(c) 3

(d) 7

(e) 6

2) As per the report, When was the Securities and Exchange Board of India ordering market infrastructure institutions to start implementing uniform charges?

(a) September 1, 2024

(b) October 1, 2024

(c) August 1, 2024

(d) November 1, 2024

(e) December 1, 2024

3) Which bank has made public that it will be upgrading its Core Banking System (CBS) and client experience on July 13, 2024?

(a) ICICI bank

(b) HDFC bank

(c) Axis bank

(d) YES bank

(e) South Indian bank

4) For high-value clients in the RUSU markets, Union Bank of India opened “Union Premier” branches. In RUSU, what does the second “U” stand for?

(a) Unit

(b) Upper

(c) Urban

(d) Usage

(e) Under

5) What percentage of the total contribution made by non-resident Indians (NRIs), Overseas Citizens of India (OCIs), and Resident Indians (RI) to the Foreign Portfolio Investors (FPIs) corpus that is based out of the International Financial Services Center (IFSC) has been permitted by the markets regulator, Securities and Exchange Board of India (SEBI)?

(a) 50%

(b) 75%

(c) 80%

(d) 95%

(e) 100%

6) The biggest Performance Surety Bond in India, worth over Rs 100 crores, was issued by Tata AIG General Insurance in Mumbai, Maharashtra. India wants to be the_________ largest economy in the world by 2030, but its acceptability and performance with surety insurance bonds are crucial to this goal.

(a) 2nd

(b) 3rd

(c) 4th

(d) 5th

(e) 1st

7) In July 2024, ICICI Lombard launched Surety Insurance to provide risk reduction solutions tailored to India’s booming infrastructure industry. Surety is a special sort of insurance since it requires how many parties to agree?

(a) 4

(b) 5

(c) 6

(d) 3

(e) 2

8) In July 2024, In which state would Air India invest over ₹200 crore to create South Asia’s largest flight training school?

(a) Sikkim

(b) Madhya Pradesh

(c) Maharashtra

(d) Kerala

(e) West Bengal

9) The HSBC India Manufacturing Purchasing Managers’ Index (PMI) increased to ___________, up from 57.5 in May 2024, suggesting a more significant improvement in business conditions.

(a) 58.2

(b) 57.2

(c) 58.3

(d) 57.3

(e) 59.2

10) The Indian government intends to upgrade the National Test House (NTH), an industrial testing lab under which Ministry, to the highest certifying agency for all Indian products?

(a) Home affairs

(b) Consumer affairs

(c) Agriculture

(d) Finance

(e) Statistics and Programme Implementation

11) India will revise the base years for national accounts and significant macroeconomic indicatorsfrom January to February 2026. Which ministry is undertaking a market survey to determine when 2024 will be the new base year for CPI, reflecting current consumption patterns?

(a) Home affairs

(b) Consumer affairs

(c) MSME

(d) Finance

(e) Statistics and Programme Implementation

12) In June 2024, India’s GST collection was Rs 1.74 trillion, marking a 7.7% year-on-year increase that was lower than in previous months. How much lakh crores were collected in total throughout the fiscal year (April-June)?

(a) Rs 5.57 lakh crore

(b) Rs 6.57 lakh crore

(c) Rs 7.57 lakh crore

(d) Rs 4.57 lakh crore

(e) Rs 8.57 lakh crore

13) The Bangladesh Navy has concluded a large contract with India’s Garden Reach Shipbuilders and Engineers (GRSE) for a __________tonne ocean-going tug, as part of India’s $500-million line of credit for defence equipment acquisitions.

(a) 700

(b) 800

(c) 900

(d) 600

(e) 500

14) The Reserve Bank of India (RBI) has announced the appointment of Arnab Kumar Chowdhury and Charulatha S. Kar as executive directors. Ms. Kar formerly served as the Chief General Manager-in-Charge of which Department?

(a) Department of Supervision

(b) Human Resource Management

(c) Foreign exchange department

(d) Department of Communication

(e) International department

15) According to the FSIB report, the Financial Services Institutions Bureau (FSIB) has proposed Challa Sreenivasulu Setty, one of the managing directors of the State Bank of India (SBI), as the bank’s next chairman. Challa Sreenivasulu Setty is set to become SBI’s __________ Chairman.

(a) 25th

(b) 27th

(c) 29th

(d) 26th

(e) 24th

16) Which of the following has appointed Siddhartha Mohanty, its chairman, to the positions of managing director (MD) and chief executive officer (CEO)?

(a) LIC

(b) SBI Life Insurance

(c) NABARD

(d) HPCL

(e) Indian bank

17) The 13th joint military exercise between India and Thailand, known as MAITREE, is taking place in Fort Vachiraprakan in Thailand’s Tak Province, and the Indian Army contingent is leaving for it. In September 2019, which state held the previous edition of the exercise?

(a) Meghalaya

(b) Madhya Pradesh

(c) Maharashtra

(d) Kerala

(e) West Bengal

18) The T20 World Cup victors would receive Rs. 125 crores, according to BCCI Secretary Jay Shah. It surpasses the bonus awarded three times following India’s ______ ODI World Cup triumph.

(a) 2012

(b) 2010

(c) 2011

(d) 2009

(e) 2008

19) The tenth Leon Masters chess competition was won by Viswanathan Anand, the former Indian world chess champion. This was an incredible accomplishment. He triumphed over Jaime Santos Latasa of which country in the championship match?

(a) Bulgaria

(b) Spain

(c) Madagascar

(d) Germany

(e) France

20) As per the report, Laura Wolvaardt Creates History with Century in All International Formats. Which nation does she belong to?

(a) Australia

(b) England

(c) South Africa

(d) Srilanka

(e) New Zealand

21) FIDE has declared that Singapore would host the 2024 World Championship match between India’s D Gukesh and the defending champion, Ding Liren from which country?

(a) China

(b) Japan

(c) Spain

(d) Germany

(e) Bulgaria

22) Dinesh Karthik, a former India wicketkeeper and batsman who recently resigned from all forms of cricket, has been named the batting coach and mentor for which team?

(a) CSK

(b) RCB

(c) KKR

(d) SRH

(e) MI

23) In which year was July 3rd of the inaugural International Plastic Bag Free Day commemorated by Rezero, a member of Zero Waste Europe (ZWE)?

(a) 2006

(b) 2008

(c) 2005

(d) 2007

(e) 2009

24) Which nation and India are participating in the joint military exercise “Ekuverin”?

(a) Indonesia

(b) Mongolia

(c) Maldives

(d) Nepal

(e) Srilanka

25) Which country made history in 2022 by becoming the first to officially restrict the use of thin, single-use plastic bags?

(a) Australia

(b) Nepal

(c) South Africa

(d) Srilanka

(e) Bangladesh

Answers :

1) Answer: B

Short Explanation:

The Reserve Bank of India (RBI) has joined hands with the Bank for International Settlements (BIS) and central banks of 4 Asean (Association of Southeast Asian Nations) countries to collaborate on Project Nexus – a multilateral international initiative to enable retail cross-border payments.

The platform, which is expected to go live by 2026, will interlink domestic fast payment systems (FPS) of countries namely Malaysia, the Philippines, Singapore, Thailand and India.

Detailed Explanation:

The Reserve Bank of India (RBI) has joined hands with the Bank for International Settlements (BIS) and central banks of 4 Asean (Association of Southeast Asian Nations) countries to collaborate on Project Nexus – a multilateral international initiative to enable retail cross-border payments.

The platform, which is expected to go live by 2026, will interlink domestic fast payment systems (FPS) of countries namely Malaysia, the Philippines, Singapore, Thailand and India.

The central banks of these countries are the founding members and first movers of the platform.

What is Project Nexus?

Project Nexus is conceptualised by the Innovation Hub of the BIS.

It seeks to enhance cross-border payments by connecting multiple domestic instant payment systems (IPS) globally.

It is the first BIS Innovation Hub project in the payments area to move towards live implementation.

The RBI has been collaborating bilaterally with various countries to link India’s Fast Payments System (FPS) –Unified Payments Interface (UPI), with their respective FPSs for cross-border Person to Person (P2P) and Person to Merchant (P2M) payments.

2) Answer: B

Short Explanation:

The Securities and Exchange Board of India (SEBI) has instructed market infrastructure institutions (MIIs), including stock exchanges, to charge all their members uniformly from October 1, 2024 without any discounts based on trading volumes.

Members of MIIs typically include financial institutions, security issuers, investors, and regulatory authorities.

Current Practice:Currently, some MIIs use a volume-based slab charge structure, where members (e.g stock brokers, depository participants, or clearing members) collect charges from their clients daily but pay MIIs monthly with volume-based paybacks.

Detailed Explanation:

The Securities and Exchange Board of India (SEBI) has instructed market infrastructure institutions (MIIs), including stock exchanges, to charge all their members uniformly from October 1, 2024 without any discounts based on trading volumes.

Members of MIIs typically include financial institutions, security issuers, investors, and regulatory authorities.

Current Practice:Currently, some MIIs use a volume-based slab charge structure, where members (e.g stock brokers, depository participants, or clearing members) collect charges from their clients daily but pay MIIs monthly with volume-based paybacks.

SEBI’s Emphasis on Fair Access : In a circular issued on July 1,2024 Sebi emphasises that MIIs, being public utility institutions, act as first-level regulators and are entrusted with the responsibility of providing equal, unrestricted, transparent and fair access to all market participants.

Stock Brokers’ Current Practices : Stock brokers are currently making the most of a grey area in the rules on exchange transaction charges (ETC), a fee charged by the exchanges from investors for trades done on their platforms.

New Charge Structure : The new uniform charge structure for MIIs should consider existing per unit charges to ensure end clients benefit from reduced charges.

3) Answer: B

Short Explanation:

HDFC Bank has announced a scheduled system upgrade on July 13, 2024, to enhance its Core Banking System (CBS) and improve customer experience.

The upgrade will “migrate” the CBS to a new platform.

The system upgrade will start at 3 am on July 13, 2024 and conclude at 4:30 pm on the same day, spanning 13.5 hours.

Detailed Explanation:

HDFC Bank has announced a scheduled system upgrade on July 13, 2024, to enhance its Core Banking System (CBS) and improve customer experience.

The upgrade will “migrate” the CBS to a new platform.

The system upgrade will start at 3 am on July 13, 2024 and conclude at 4:30 pm on the same day, spanning 13.5 hours.

Impact on Services: During the upgrade period:

Certain services will have temporary limitations.

Critical services will be available but with restrictions.

UPI services will be unavailable from 3 am to 3:45 am and from 9:30 am to 12:45 pm.

Net and mobile banking services will be inaccessible throughout the entire upgrade period.

All fund transfer modes (Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), HDFC Bank account-to-account online transfers, and branch transfers) will also be unavailable.

Customer Advisory: HDFC Bank advises customers to withdraw sufficient funds before 7:30 pm on July 12, 2024, to minimize disruption during the upgrade.

4) Answer: C

Short Explanation:

Union Bank of India launched “Union Premier” branches for high-value customers in rural and semi-urban (RUSU) markets.

Aim : To provide personalized banking services for high-value customers in RUSU markets.

Range of Services:Union Premier branches will offer a wide range of products and services under one roof.

Detailed Explanation:

Union Bank of India launched “Union Premier” branches for high-value customers in rural and semi-urban (RUSU) markets.

Aim : To provide personalized banking services for high-value customers in RUSU markets.

Range of Services:Union Premier branches will offer a wide range of products and services under one roof.

Personalized Banking:Each Union Premier customer will have access to a personal Relationship Manager to address all their banking needs.

Technology Integration:These exclusive branches are equipped with the latest digital technologies to ensure seamless and efficient banking

5) Answer: E

Short Explanation:

Markets regulator Securities and Exchange Board of India (SEBI) has allowed up to 100% aggregate contribution by non-resident Indians (NRIs), Overseas Citizens of India (OCIs), Resident Indians (RI) in the corpus of Foreign Portfolio Investors (FPIs) that are based out of International Financial Services Centre (IFSC).

Detailed Explanation:

Markets regulator Securities and Exchange Board of India (SEBI) has allowed up to 100% aggregate contribution by non-resident Indians (NRIs), Overseas Citizens of India (OCIs), Resident Indians (RI) in the corpus of Foreign Portfolio Investors (FPIs) that are based out of International Financial Services Centre (IFSC).

Registration Requirement:At the time of registration, an FPI applicant must declare to their Designated Depository Participant (DDP) if they intend to have 50% or more of their corpus contributed by NRIs, OCIs, and RIs.

Declaration Timeline for Existing FPIs:Existing FPIs have 6 months from the date of the SEBI circular to submit the required declaration.

The declaration can only be reviewed during the renewal of registration.

Constituents of FPIs:According to SEBI’s notification on June 25, NRIs, OCIs, and RIs can be constituents of an FPI.

Contribution Limits:The contribution of a single NRI, OCI, or RI must be less than 25% of the total FPI corpus.

The combined contribution from NRIs, OCIs, and RIs must be less than 50% of the total FPI corpus.

6) Answer: B

Short Explanation:

Tata AIG General Insurance has issued India’s largest Performance Surety Bond, valued at over Rs 100 crores in Mumbai, Maharashtra, India.

This issuance follows the company’s introduction of Surety Insurance Bond offerings to the market two months ago.

Economic Impact:There is an estimated requirement of approximately Rs 90-lakh crore in bank guarantees over the next 5 years.

The acceptance and success of surety insurance bonds are critical to India’s ambition of becoming the 3rd-largest economy by 2030.

Detailed Explanation:

Tata AIG General Insurance has issued India’s largest Performance Surety Bond, valued at over Rs 100 crores in Mumbai, Maharashtra, India.

This issuance follows the company’s introduction of Surety Insurance Bond offerings to the market two months ago.

Purpose of Surety Insurance Bonds : Surety Insurance Bonds are designed to protect project owners or beneficiaries from losses resulting from a contractor’s non-performance, non-fulfillment, or breach of contractual obligations as outlined in agreements or bidding documents.

These bonds are available in both conditional and unconditional formats.

Government Policy:In India, the government has permitted contractors to offer surety bonds instead of bank guarantees.

Economic Impact:There is an estimated requirement of approximately Rs 90-lakh crore in bank guarantees over the next 5 years.

The acceptance and success of surety insurance bonds are critical to India’s ambition of becoming the 3rd-largest economy by 2030.

7) Answer: D

Short Explanation:

ICICI Lombard has introduced Surety Insurance to offer risk mitigation solutions specifically for India’s growing infrastructure sector.

Surety is a unique type of insurance because it involves a three-party agreement.

Principal: The party that purchases the bond and undertakes an obligation to perform an act as promised.

Surety: The insurance company or surety company that guarantees the obligation will be performed.

Obligee: The party who requires, and often receives the benefit of the surety bond

Detailed Explanation:

ICICI Lombard has introduced Surety Insurance to offer risk mitigation solutions specifically for India’s growing infrastructure sector.

Purpose of Surety Insurance: Surety insurance serves as a guarantee to a beneficiary (typically a client or authority) that a principal debtor (usually a contractor) will fulfil their contractual obligations.

Financial Compensation: If the contractor fails to meet their contractual commitments, the surety insurance provider will compensate the beneficiary financially.

Surety is a unique type of insurance because it involves a three-party agreement.

The three parties in a surety agreement are:

Principal: The party that purchases the bond and undertakes an obligation to perform an act as promised.

Surety: The insurance company or surety company that guarantees the obligation will be performed.

If the principal fails to perform the act as promised, the surety is contractually liable for losses sustained.

Obligee: The party who requires, and often receives the benefit of the surety bond.

For most surety bonds, the obligee is a local, state or federal government organization.

8) Answer: C

Short Explanation:

Air India has announced plans to establish South Asia’s largest flight training school in Maharashtra’s Amravati district, investing over ₹200 crore.

The initiative is aimed at meeting the airline’s demand for 500-700 pilots annually following a substantial order of 470 Airbus and Boeing aircraft in 2023.

Detailed Explanation:

Air India has announced plans to establish South Asia’s largest flight training school in Maharashtra’s Amravati district, investing over ₹200 crore.

The initiative is aimed at meeting the airline’s demand for 500-700 pilots annually following a substantial order of 470 Airbus and Boeing aircraft in 2023.

Infrastructure and Facilities:

Air India, in partnership with Maharashtra Airport Development Company (MADC), has leased a 10-acre plot for thirty years.

The facility will feature 31 single-engine Piper aircraft and three twin-engine Diamond aircraft.

It will train 180 commercial pilots annually with a newly extended 1,850-metre runway, modern navigation aids, and night landing facilities.

Amravati’s conducive weather with over 300 days of clean visibility will optimize training conditions.

Current Fleet and Hiring:

Air India currently operates a fleet of approximately 140 aircraft and has hired over a thousand pilots in the past two years.

9) Answer: C

Short Explanation:

In June 2024, India’s manufacturing sector rebounded strongly from a slight slowdown in May 2024.

The HSBC India Manufacturing Purchasing Managers’ Index (PMI) rose to 58.3, up from 57.5 in May 2024, indicating a sharper improvement in business conditions.

Detailed Explanation:

In June 2024, India’s manufacturing sector rebounded strongly from a slight slowdown in May 2024.

The HSBC India Manufacturing Purchasing Managers’ Index (PMI) rose to 58.3, up from 57.5 in May 2024, indicating a sharper improvement in business conditions.

Employment and Hiring:

Hiring in the manufacturing sector reached the highest level in at least 19 years, indicating robust growth in employment.

Optimism and Outlook:

Despite strong current performance, optimism among manufacturers about future prospects dipped to a three-month low.

Approximately 29% of firms anticipate growth in output over the coming year.

10) Answer: B

Short Explanation:

The Indian government plans to elevate the National Test House (NTH), an industrial testing lab under the Consumer Affairs Ministry, as the apex certification body for all Indian products.

This initiative aims to address recent export rejections and enhance global acceptance of Indian goods.

Detailed Explanation:

The Indian government plans to elevate the National Test House (NTH), an industrial testing lab under the Consumer Affairs Ministry, as the apex certification body for all Indian products.

This initiative aims to address recent export rejections and enhance global acceptance of Indian goods.

Expansion and Role of NTH:

The NTH will establish a network of labs nationwide to oversee the final certification of all products, including food, spices, and organic goods, ensuring they meet global standards.

This move is part of efforts to complete the setup and operation of NTH labs within the first 125 days of the new government.

NTH’s Existing Responsibilities:

Apart from its new role, NTH, established over a century ago, also tests various products, including drones.

NTH scientists play a crucial role in evaluating crop loss data for compensation under the PMFBY, highlighting their multifaceted contributions.

11) Answer: E

Short Explanation:

India is set to update the base years for national accounts and major macro-indicators starting from January to February 2026, coinciding with the first and second advance estimates of national income for FY26.

The Advisory Committee on National Accounts Statistics (ACNAS) has been established to advise on the new base year for GDP and alignment with other macro-indicators.

The Ministry of Statistics and Programme Implementation (MoSPI) is conducting a market survey to potentially adopt 2024 as the new base year for CPI, reflecting current consumption patterns.

Detailed Explanation:

India is set to update the base years for national accounts and major macro-indicators starting from January to February 2026, coinciding with the first and second advance estimates of national income for FY26.

Advisory Committee and Timeline:

The Advisory Committee on National Accounts Statistics (ACNAS) has been established to advise on the new base year for GDP and alignment with other macro-indicators.

From January-February 2026, updated base years will be implemented for GDP and other indicators to ensure consistency in economic analysis.

Scope of Updates:

The revision includes major indicators such as GDP, wholesale price index (WPI), consumer price index (CPI), and index of industrial production (IIP).

WPI measures wholesale inflation, CPI determines consumer inflation, and IIP calculates industrial growth, all crucial for economic policy and planning.

Specific Base Years:

The Ministry of Statistics and Programme Implementation (MoSPI) is conducting a market survey to potentially adopt 2024 as the new base year for CPI, reflecting current consumption patterns.

Previously, in January 2015, India transitioned to a base year of 2011-12 for national accounts, replacing the earlier base year of 2004-05, following recommendations from the National Statistical Commission (NSC) for more frequent updates.

12) Answer: A

Short Explanation:

In June 2024, India’s GST collection reached Rs 1.74 trillion, marking a 7.7% year-on-year growth, which is lower than previous months’ increases (12.4% in April and 10% in May 2024).

Cumulative collections for the fiscal year totalled Rs 5.57 trillion.

Detailed Explanation:

In June 2024, India’s GST collection reached Rs 1.74 trillion, marking a 7.7% year-on-year growth, which is lower than previous months’ increases (12.4% in April and 10% in May 2024).

Cumulative collections for the fiscal year totalled Rs 5.57 trillion.

Breakdown of Collection and State Revenues:

Central GST received Rs 39,600 crore from IGST collections, while states received Rs 33,548 crore.

The seventh anniversary of the GST rollout was celebrated under the theme “SashaktVyaparSamagra Vikas,” highlighting reduced tax rates on household goods post-GST implementation.

Expert Insights and Industry Outlook:

Experts like Pratik Jain from PwC India noted the positive trend in GST collections, urging rate rationalization by the GST Council.

Saurabh Agarwal from EY credited effective enforcement and compliance measures for sustaining collection buoyancy amidst economic stability.

Introduction: GST was introduced on July 1, 2017, replacing multiple indirect taxes.

13) Answer: B

Short Explanation:

The Bangladesh Navy has finalized a significant contract with India’s Garden Reach Shipbuilders and Engineers (GRSE) for an 800-tonne ocean-going tug, under a $500-million line of credit extended by India for defence equipment purchases.

Contract Details:

The deal, worth approximately $21 million, was signed in Dhaka, facilitated by GRSE and the Bangladesh Navy’s directorate general of defence purchases.

The tug is scheduled for delivery within 24 months and will measure 61 meters in length and 15.80 meters in width, capable of reaching speeds of at least 13 knots when fully loaded.

Detailed Explanation:

The Bangladesh Navy has finalized a significant contract with India’s Garden Reach Shipbuilders and Engineers (GRSE) for an 800-tonne ocean-going tug, under a $500-million line of credit extended by India for defence equipment purchases.

Contract Details:

The deal, worth approximately $21 million, was signed in Dhaka, facilitated by GRSE and the Bangladesh Navy’s directorate general of defence purchases.

The tug is scheduled for delivery within 24 months and will measure 61 meters in length and 15.80 meters in width, capable of reaching speeds of at least 13 knots when fully loaded.

14) Answer: B

Short Explanation:

The Reserve Bank of India (RBI) announced the appointment of Arnab Kumar Chowdhury and Charulatha S. Kar as executive directors (EDs).

Before becoming executive directors, Mr. Chowdhury was the Chief General Manager-in-Charge in the Department of Supervision.

Ms. Kar was serving as Chief General Manager-in-Charge in the Human Resource Management Department.

Detailed Explanation:

The Reserve Bank of India (RBI) announced the appointment of Arnab Kumar Chowdhury and Charulatha S. Kar as executive directors (EDs).

Mr. Chowdhury’s appointment is effective from June 3, 2024, while Ms. Kar’s appointment is effective from July 1, 2024.

Mr. Chowdhury will oversee the Deposit Insurance and Credit Guarantee Corporation (DICGC), foreign exchange department, and international department.

Ms. Kar will manage the Department of Communication, Human Resource Management Department, and Right to Information (First Appellate Authority).

Before becoming executive directors, Mr. Chowdhury was the Chief General Manager-in-Charge in the Department of Supervision.

Ms. Kar was serving as Chief General Manager-in-Charge in the Human Resource Management Department.

15) Answer: B

Short Explanation:

The Financial Services Institutions Bureau (FSIB), has recommended Challa Sreenivasulu Setty, who is one of the managing directors of State Bank of India (SBI) as the next Chairman of State Bank of India (SBI).

Challa Sreenivasulu Setty will be the 27th Chairman of SBI.

SBI’s current Chairman, Dinesh Kumar Khara, will retire on August 28, 2024, upon turning 63.

Detailed Explanation:

The Financial Services Institutions Bureau (FSIB), has recommended Challa Sreenivasulu Setty, who is one of the managing directors of State Bank of India (SBI) as the next Chairman of State Bank of India (SBI).

Challa Sreenivasulu Setty will be the 27th Chairman of SBI.

SBI’s current Chairman, Dinesh Kumar Khara, will retire on August 28, 2024, upon turning 63.

Khara was appointed Chairman on October 7, 2020, and received an extension in October 2023.

FSIB interviewed three managing directors for the position of SBI Chairman.

The final decision will be made by the Appointments Committee of the Cabinet (ACC) headed by the Prime Minister.

16) Answer: A

Short Explanation:

Life Insurance Corporation of India (LIC) has re-designated its chairman Siddhartha Mohanty as managing director (MD) and chief executive officer (CEO), with effect from June 30, 2024.

Mohanty was appointed as the chairperson of LIC in April 2023 until June 29, 2024.

Thereafter, he was scheduled to take over the role of MD & CEO of the corporation until June 7, 2025.

Detailed Explanation:

Life Insurance Corporation of India (LIC) has re-designated its chairman Siddhartha Mohanty as managing director (MD) and chief executive officer (CEO), with effect from June 30, 2024.

Mohanty was appointed as the chairperson of LIC in April 2023 until June 29, 2024.

Thereafter, he was scheduled to take over the role of MD & CEO of the corporation until June 7, 2025.

In his nearly four decades in LIC, Mohanty has held several key positions, including that of the chief operating officer (COO) and the CEO of LIC Housing Finance and has also served as the senior divisional manager of Raipur and Cuttack, chief (Legal), chief (investment – monitoring and accounting), and executive director (Legal).

17) Answer: A

Short Explanation:

The Indian Army contingent departed for the 13th edition of India- Thailand joint military Exercise MAITREE.

The exercise is scheduled to be conducted from 1st to 15th July 2024 at Fort Vachiraprakan in Tak Province of Thailand.

Exercise MAITREE is an annual training event which has been conducted alternatively in Thailand and India since 2006.

Last edition of the exercise was conducted at Umroi, Meghalaya in September 2019.

Detailed Explanation:

The Indian Army contingent departed for the 13th edition of India- Thailand joint military Exercise MAITREE.

The exercise is scheduled to be conducted from 1st to 15th July 2024 at Fort Vachiraprakan in Tak Province of Thailand.

Exercise MAITREE is an annual training event which has been conducted alternatively in Thailand and India since 2006.

Last edition of the exercise was conducted at Umroi, Meghalaya in September 2019.

Participating Contingents:The Indian Army contingent consists of 76 personnel, primarily from the Battalion of the LADAKH SCOUTS, along with members from other arms and services.

The Royal Thailand Army contingent also has 76 personnel, mainly from the 1st Battalion, 14 Infantry Regiment of the 4th Division.

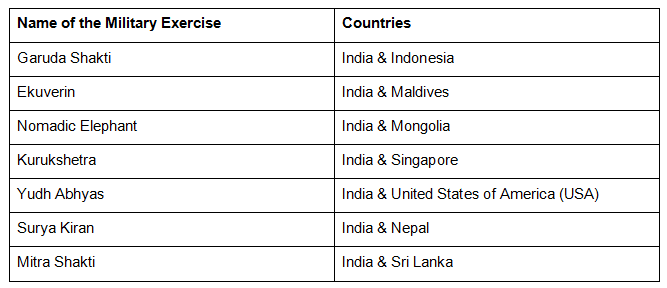

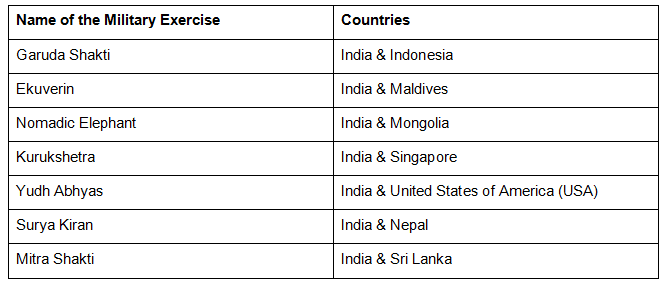

Joint Military Exercises of India with Other Countries

18) Answer: C

Short Explanation:

BCCI offers Rs. 125 crore to Indian men’s T20 World Cup-winning squad.

Exceeds threefold the bonus given after India’s 2011 ODI World Cup victory.

Inclusive Reward: Includes players, coaches, support staff, and selectors.

Detailed Explanation:

BCCI offers Rs. 125 crore to Indian men’s T20 World Cup-winning squad.

Exceeds threefold the bonus given after India’s 2011 ODI World Cup victory.

Inclusive Reward: Includes players, coaches, support staff, and selectors.

Cash Prize Details: BCCI Secretary Jay Shah announced Rs. 125 crores for the T20 World Cup champions.

Scope of Reward: Covers players, coaches, support staff, and selectors, recognizing their contributions.

Tournament Victory: Rohit Sharma-led Team India clinched victory over South Africa in a thrilling final.

Financial Growth: BCCI’s financial health significantly grew from Rs. 189.72 crore surplus in 2010-11 to Rs. 5,197.71 crore in 2021-22.

Historical Context: Contrast with 2011, when BCCI initially offered Rs. 1 crore per player, later revised to Rs. 2 crores due to player feedback.

19) Answer: B

Short Explanation:

Viswanathan Anand, former world chess champion from India, achieved a remarkable milestone by clinching the Leon Masters chess championship for the 10th time.

In the final match, he defeated Jaime Santos Latasa of Spain with a commanding score of 3-1.

Detailed Explanation:

Viswanathan Anand, former world chess champion from India, achieved a remarkable milestone by clinching the Leon Masters chess championship for the 10th time.

In the final match, he defeated Jaime Santos Latasa of Spain with a commanding score of 3-1.

Tournament Overview:

The Leon Masters is a prestigious chess tournament held annually in Leon, Spain, featuring four top players.

Participants in the 2024 edition included

Viswanathan Anand (INDIA)

Arjun Erigaisi (INDIA)

Veselin Topalov (BULGARIA) and

Jaime Santos Latasa (SPAIN)

Anand’s previous wins at the Leon Masters occurred in 1996, 1999, 2000, 2001, 2005, 2006, 2007, 2011, 2016, and now 2024, showcasing his consistency and longevity in competitive chess.

20) Answer: C

Short Explanation:

During South Africa’s one-off Test against India in Chennai, Laura Wolvaardt achieved a historic milestone by becoming the first South African woman to score centuries in all three formats of international cricket.

She is also the first woman and third player overall from South Africa to achieve centuries in Tests, ODIs, and T20Is, joining a select group in international cricket.

Detailed Explanation:

During South Africa’s one-off Test against India in Chennai, Laura Wolvaardt achieved a historic milestone by becoming the first South African woman to score centuries in all three formats of international cricket.

Test Match Performance:

Despite India’s dominant first innings total of 603-6 declared, including significant contributions from multiple Indian players, South Africa faced challenges in their batting innings.

Wolvaardt’s Century and Milestone:

Laura Wolvaardt, batting amid difficulties, scored her maiden Test century, becoming only the sixth South African woman to achieve this milestone in Test cricket history.

She is also the first woman and third player overall from South Africa to achieve centuries in Tests, ODIs, and T20Is, joining a select group in international cricket.

21) Answer: A

Short Explanation:

FIDE has announced that Singapore will host the 2024 World Championship match between India’s D Gukesh and defending champion Ding Liren from China.

The event is scheduled to take place from November 20 to December 15.

Detailed Explanation:

FIDE has announced that Singapore will host the 2024 World Championship match between India’s D Gukesh and defending champion Ding Liren from China.

The event is scheduled to take place from November 20 to December 15.

Host Selection:

Singapore won the bid to host the World Championship match, supported by the Singapore Chess Federation and the Government of Singapore.

The decision follows a thorough review of bids and inspections of potential host cities, evaluating venues, amenities, event programs, and opportunities.

Event Details:

The World Championship match is a highly anticipated event in the chess calendar, drawing attention from global chess enthusiasts and players alike.

Both Gukesh and Ding Liren are expected to compete fiercely for the prestigious title during the championship.

22) Answer: B

Short Explanation:

Former India wicketkeeper-batter Dinesh Karthik, who recently retired from all forms of cricket, has been appointed as the batting coach and mentor for Royal Challengers Bengaluru.

IPL Career and Teams:

Dinesh Karthik appeared in 257 IPL matches, amassing 4,842 runs across his career with an average of 26.32.

He represented various IPL teams including Kolkata Knight Riders, Mumbai Indians, Delhi Daredevils, Kings XI Punjab, and now Royal Challengers Bengaluru.

Detailed Explanation:

Former India wicketkeeper-batter Dinesh Karthik, who recently retired from all forms of cricket, has been appointed as the batting coach and mentor for Royal Challengers Bengaluru.

IPL Career and Teams:

Dinesh Karthik appeared in 257 IPL matches, amassing 4,842 runs across his career with an average of 26.32.

He represented various IPL teams including Kolkata Knight Riders, Mumbai Indians, Delhi Daredevils, Kings XI Punjab, and now Royal Challengers Bengaluru.

International Career Highlights:

In ODIs, Karthik scored 1,792 runs with nine half-centuries in 94 matches.

His Test career saw him accumulate 1,025 runs, including a century against Bangladesh, from 42 innings.

Karthik also contributed 686 runs in 60 T20Is for India.

Role with RCB:

Karthik’s new role as batting coach and mentor for RCB marks his transition into coaching after retiring from professional cricket.

His experience and insights are expected to benefit the team’s batting lineup and player development.

23) Answer: B

Short Explanation:

International Plastic Bag Free Day 2024 is observed on July 3 every year to motivate people to avoid using single-use plastic to eliminate plastic pollution.

Rezero, a member of Zero Waste Europe (ZWE), initiated the first International Plastic Bag Free Day which was observed on July 3, 2008.

Detailed Explanation:

International Plastic Bag Free Day 2024 is observed on July 3 every year to motivate people to avoid using single-use plastic to eliminate plastic pollution.

Bag Free World organization established the International Plastic Bag Free Day.

This organization introduced several campaigns promoting a plastic-free world that inspired other parts of the world to participate in Plastic Bag Free Day.

Rezero, a member of Zero Waste Europe (ZWE), initiated the first International Plastic Bag Free Day which was observed on July 3, 2008.

In 2015, the European Union also passed certain directives to reduce the usage of single-use plastic bags.

Bangladesh became the first country to ban the use of single-use, thin plastic bags officially in 2022.

Soon after, many more countries, including India, also banned single-use plastic.

24) Answer: C

25) Answer: E

Rezero, a member of Zero Waste Europe (ZWE), initiated the first International Plastic Bag Free Day which was observed on July 3, 2008.

In 2015, the European Union also passed certain directives to reduce the usage of single-use plastic bags.

Bangladesh became the first country to ban the use of single-use, thin plastic bags officially in 2022.

Soon after, many more countries, including India, also banned single-use plastic.