Union government crosses its asset monetization target for FY -22

What is the news :

- According to the evaluation made at a high-level review meeting, the central government has exceeded its asset monetization target of 88,000 crore for FY22 and has concluded agreements worth 96,000 crore.

- Roads, power, and coal and mineral mining are among the industries that have made significant contributions to asset monetisation.

- The Centre has set an asset monetisation target of over 1.6 trillion dollars for FY23, for which proposals from various ministries are in various stages of processing.

Asset monetization plan :

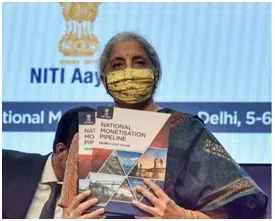

- The asset monetisation plan was announced by finance minister Nirmala Sitharaman in her union budget for FY22 as an important financing option for creating new infrastructure assets.

- The plan entailed a pipeline of ₹6 trillion worth of assets to be monetised in a four year period till FY25. The government expects the asset sale achieved in FY22 to trigger another ₹9 trillion of cumulative investments as the asset acquirers raise debt and expand their operations.

- The idea is to crowd in private investments in infrastructure, a key element of the government’s economic recovery strategy.

- There will be rigorous monitoring of the asset monetisation programme in FY23. Private debt to GDP ratio in India is at around 56%, which is lower than in many other countries.

- Asset sale programme will facilitate more debt and equity investments into the infrastructure sector.

- It will be done in active partnership with states,” said the first official quoted above. States and union territories have significant infrastructure asset base that can be leveraged to enhance their investment in the sector, said the official.

Key points:

- Prominent investors who purchased assets in FY22 include CPP Investments, Ontario Teachers Pension Plan, and Utilico Emerging Markets Trust Plc. At the time of publication, emails made to these investors evening had gone unanswered.

- When the final data are in, the total asset sale in FY22 could reach $1 trillion.

- Senior officials from the finance and infrastructure ministries, as well as the NITI Aayog, attended the meeting, which was headed by Finance Minister Nirmala Sitharaman.

Contribution of Roads, power, and coal and mineral mining:

- In FY22, 390 kilometers of road projects were monetised under the infrastructure investment trust mode and three ‘toll-operate-transfer’ bundles were bid out, the person said.

- This has fetched ₹23,000 crores, the person said. In the power sector, transmission and hydel power assets worth ₹9,500 crore have been monetised.

- In the mining sector, 31 mineral blocks have been auctioned with estimated annual monetisation value of about ₹18,700 crores in FY22. These have helped states to raise resources for capital funding requirement.

What is Asset monetization :

- Asset Monetization involves creation of new sources of revenue by unlocking of value of hitherto unutilized or underutilized public assets.

- To monetise something means to ‘express it or convert it into the form of currency’. Basically, monetising is ‘to utilise (something of value) as a source of profit,’ or ‘to convert an asset into money or a legal tender.’ For example, a government can monetise the nation’s debt by acquiring debt treasuries, which increases the supply of money. Consequently, the debt is turned into money, or in other words, it is monetised.

- Internationally, it is recognized that public assets are a significant resource for all economies. Monetizing these assets that Government’s control, including n Public corporations, is widely held to be a very important but inadequately explored public finance option for managing public resources.

- Many public sector assets are sub-optimally utilised and could be appropriately monetized to create greater financial leverage and value for the companies and of the equity that the government has invested in them.

- The objective of the asset monetization programme of the Government of India (GOI), for which this note lays down procedures and mechanism, is to unlock the value of investment made in public assets which have not yielded appropriate or potential returns so far, create hitherto unexplored sources of income for the company and its shareholders, and contribute to a more accurate estimation of public assets which would help in better financial management of government/public resources over time.

National Monetisation Pipeline

- The government of India announced the National Monetisation Pipeline (NMP) worth Rs 6 trillion on August 23 in 2021.

- This scheme aims to serve as a roadmap for the asset monetisation of several brownfield infrastructure assets across sectors including roads, railways, aviation, power, oil and gas, and warehousing.

Sector wise Monetisation Pipeline over FY 2022-25 (Rs crore)

- NMP is a central portal that could act as a land bank housing information about all assets that have been lined up for utilisation by strategic investors or private sector companies. It will also assess the potential value of unused and underutilised government assets.

- The NMP targets to raise Rs 6 trillion through asset monetisation of the central government, over a four-year period, from FY22 to FY25. However, the ownership of the assets will be retained by the Centre. NMP focuses on brownfield assets in which investments have already been made but are underutilised.

- The underutilised brownfield assets are in sectors such as roads, railways, airports, mines, and power. This initiative is necessary for bringing in private capital which will be used for infra creation.

- According to an official communique, the top five sectors in terms of contribution to NMP are roads (27%) followed by railways (25%), power (15%), oil and gas pipelines (8%), and telecom (6%).

About NITI Aayog :

- The NITI Aayog(National Institution for Transforming India) is a public policy think tank of the Government of India,.

- The aim of the NITI Aayog is to achieve sustainable development goals with cooperative federalism by fostering the involvement of State Governments of India in the economic policy-making process using a bottom-up approach.

- Founded on 1 January 2015

- Chairman: Narendra Modi

- Vice Chairman: Dr. Rajiv kumar

- CEO – Amitabh kant

Subscribe

0 Comments